Life Insurance in and around Kalispell

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

There's a common misconception that Life insurance isn't necessary when you're still young, but even if you are young and just starting out in life, now could be the right time to start thinking about Life insurance.

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Put Those Worries To Rest

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with level or flexible payments with coverage to last a lifetime coverage for a specific time frame or another coverage option, State Farm agent Matt Downing can help you with a policy that's right for you.

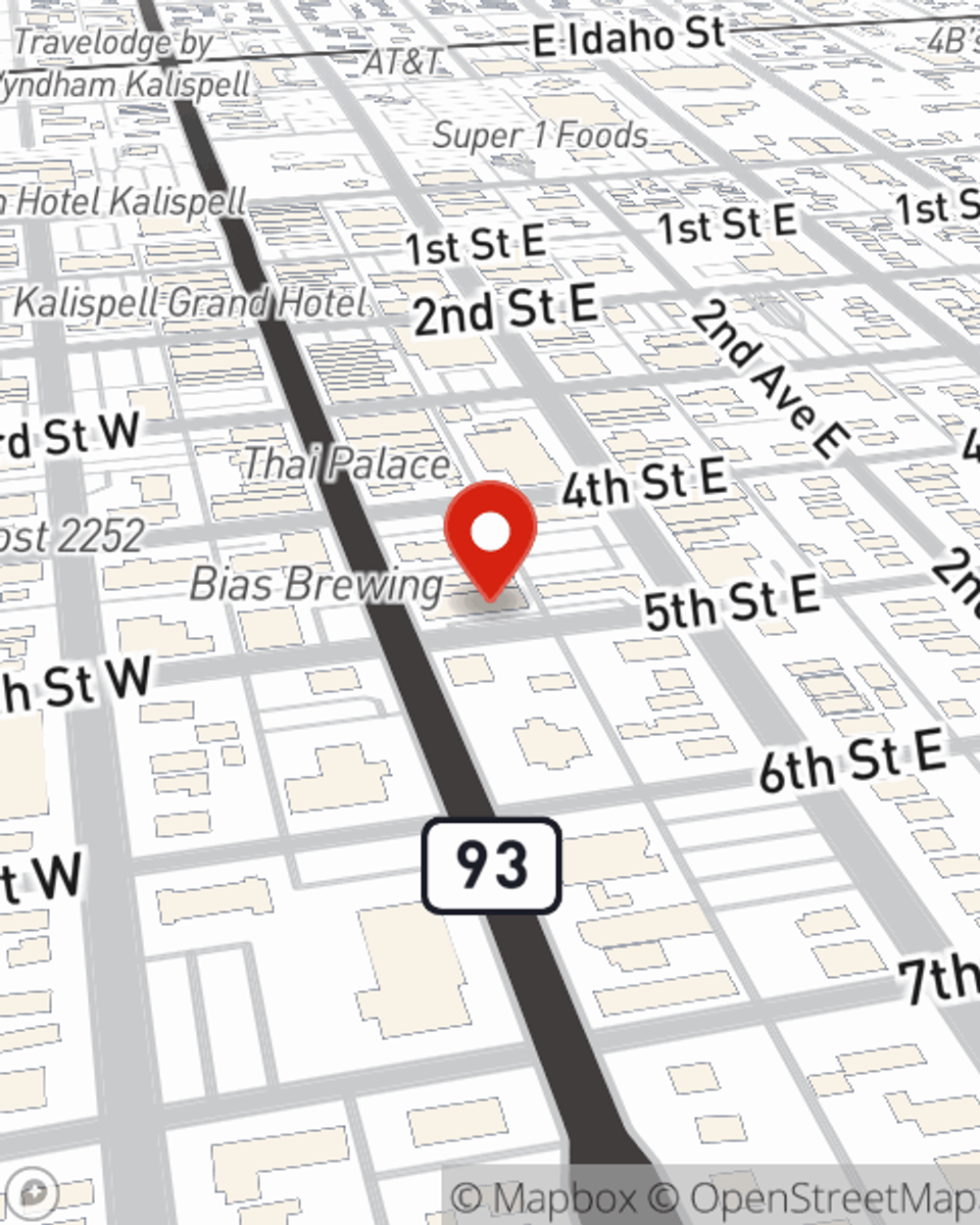

As a reliable provider of life insurance in Kalispell, MT, State Farm is committed to protect those you love most. Call State Farm agent Matt Downing today and see how you can save.

Have More Questions About Life Insurance?

Call Matt at (406) 752-2116 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Matt Downing

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.